Apply for OAS as a Non-Resident of Canada

You might have some savings with you in your local bank, as well as back home in Canada, and perhaps a private pension or retirement fund. But how about your OAS pension as you approach 65? How does one go about applying for an OAS pension from abroad as well as collecting your pension in another country, assuming you qualify?

You’ve taken the leap, or more precisely the plane flight, overseas, or loaded up your Winnebago and headed south to spend your retirement years abroad. Or you’ve been working abroad for a few years, or longer, and decided you’d like to stay there for your retirement. You might have some savings with you in your local bank, as well as back home in Canada, and perhaps a private pension or retirement fund. But how about your OAS pension as you approach 65? How does one go about applying for an OAS pension from abroad as well as collecting your pension in another country, assuming you qualify?

Who Qualifies for OAS When Living Abroad

If you are living outside of Canada you must meet three conditions:

- You must be 65 or older.

- You must have been a Canadian citizen or a legal (permanent) resident of Canada on the day before you left Canada.

- You must have resided in Canada for at least 20 years after turning 18. Please note that if you have worked abroad for Canadian employers like the Armed Forces or a financial institution like a bank, you may have your time spent working abroad counted as residency in Canada. You must have returned to Canada within 6 months of ending your employment with your Canadian employer, or have turned 65 while still employed abroad, to qualify for this exception. You will need to present proof of employment and proof of physical return to Canada as well, to have your time working abroad counted as residency in Canada.

| Replace Your Citizenship Certificate | Verify Your Canadian Status |

Does Your Country of Residence Have a Social Security Agreement with Canada?

If you have worked in a foreign country as well as in Canada, you may be eligible for a pension from either country or even from both countries. Like the idea of receiving a pension from two countries? The first step is to see if your country of residence has a social security agreement with Canada. That would be an international agreement that coordinates the pension programs of Canada and the foreign country. It may allow you to combine your periods of residence abroad with your Canadian residence to meet minimum requirements, and thus qualify, and it may provide benefits to your surviving family members. Sounds nice, doesn’t it? So, which countries do we have social security agreements with? Go here to Service Canada’s page to see if you’re eligible.

- The agreements include much of Europe as well as the Caribbean, and of course, the USA. India, South Korea, and Japan are on the list as well as Australia and New Zealand.

- Latin America comes up a little short but Brazil, Chile, and Mexico do indeed have social security agreements with Canada as does Uruguay.

- China is noticeably absent as is, surprisingly, Hong Kong.

- Each agreement is different so you will have to read up on the details. In India’s case, for example, while the agreement was signed in 2012, the legal procedures are still being completed and the text of the agreement is still not available.

- Jamaica, on the other hand, signed their social security agreement with Canada 30 years ago in early 1984 although the benefits and minimum qualifications are paid separately under each program. Nonetheless, you may be eligible to receive pensions from both countries.

- The agreement between Israel and Canada is a very limited one that deals only with temporary workers posted to work abroad in the other country – Canadians in Israel and Israelis in Canada – and which allows them to continue to contribute to the pension plan of their home country while working in the other country.

- The agreement with the United States is similar to the one with Jamaica and came was signed the same year, 1984. Benefits are paid separately by each country although each country may credit your contributions in the other country towards your pension in your home country.

As you can see, it is vital to check the details of any agreement.

If your country of residence does not have a social security agreement with Canada, you will have to apply directly to each country’s social security authorities and you will not be able to claim contributions made under one system towards meeting minimum requirements under the other.

Does Your Country of Residence Have a Tax Treaty with Canada?

Yes, Revenue Canada will still tax your Canadian income, or at least certain types of income, even if you are a non-resident. That means your OAS payments will be subjected to a 25% withholding tax, which also applies to CPP, and QPP pensions and benefits. You may be exempt or have the rate reduced, however, if your country of residence has a tax treaty with Canada. Is your country on the list?

| Argentina | Cyprus | Ireland | New Zealand | Senegal | United Kingdom |

| Australia | Dominican Republic | Israel | Norway | Spain | United States |

| Azerbaijan | Ecuador | Ivory Coast | Papua New Guinea | Sri Lanka | Zambia |

| Bangladesh | Finland | Kenya | Peru | Switzerland | Zimbabwe |

| Barbados | Germany | Malaysia | Poland | Tanzania | |

| Bulgaria | Greece | Malta | Portugal | Trinidad and Tobago | |

| Colombia | Hungary | Mexico | Romania | Turkey |

If it is, your “withholding tax” will be automatically reduced. If your country does not have a tax treaty with Canada you can file an NR5 or Application by a Non-Resident of Canada for a Reduction in the Amount of Non-Resident Tax Required to be Withheld. Go here for a link to the form.

There is also another tax, or claw-back really, that may affect your OAS payments if you are a non-resident. It is based on your net income from all sources, in Canada and abroad. Currently the threshold is CAD 70,954 for the 2013 Tax Year. As a non-resident receiving OAS, you will have to file an OASRI or Old Age Return of Income form to enable Revenue Canada to determine if you must pay what is called a recovery tax on your OAS payments. It is based on:

- Net World Income = All income from outside and inside Canada minus allowable deductions. If your net world income exceeded CAD 70,954, you had to pay a recovery tax on your OAS payments. It is calculated as follows:

- Recovery tax = 15% of all net income in excess of the threshold amount (70,954 for tax year 2013).

- If your country has a tax treaty with Canada, or if you were a resident of the Philippines in 2013, or if you migrated to or from Canada in 2013 while receiving OAS payments, then you should contact the Canada Revenue Agency for more details on your tax situation regarding your pension.

Apply for OAS

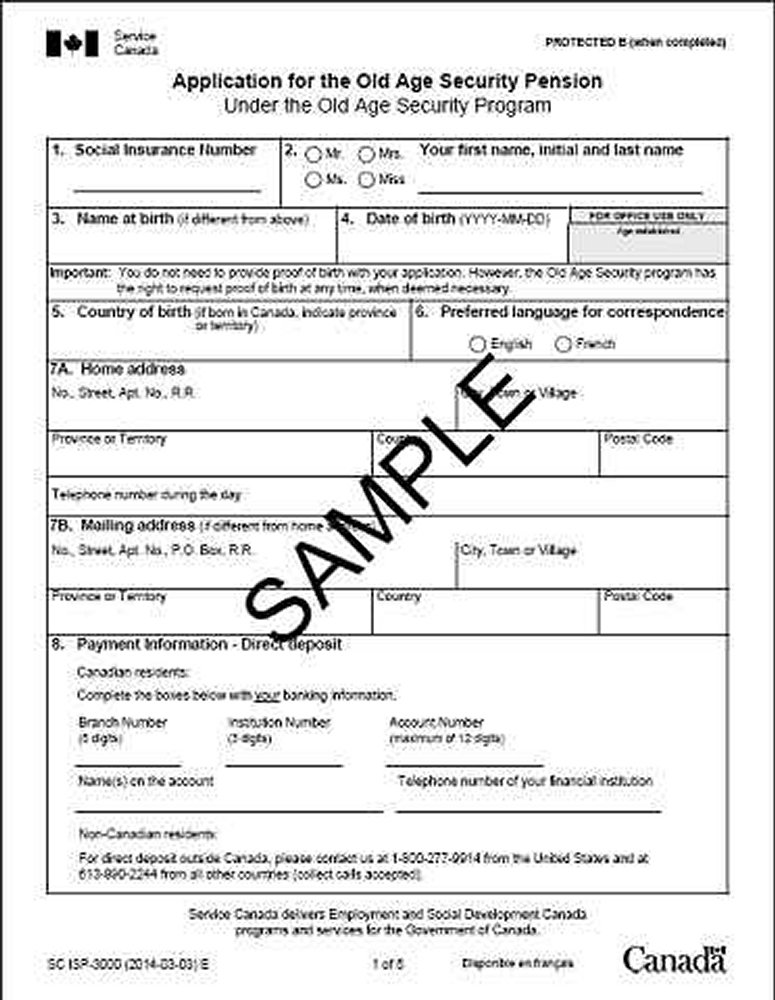

As a non-resident it is not likely you will receive a package from Service Canada within one month of turning 64, advising you of your eligibility to receive OAS, and including the application form. You will therefore need to apply as soon as you have turned 64 by going here to download and print the applicable form. You will also need to click on the link Returning the Form, to find out where to mail your completed application.

Receiving Your OAS Payments Abroad

The easiest way to receive your OAS payments is, of course, by direct deposit. See if your country of residence is on the list of countries for which the Receiver General of Canada is authorized to make a direct deposit. If on the list, click on your individual country to see if you can receive your direct deposit in the local currency, which often gives you a better exchange rate and lower fees compared to trying to cash a Government of Canada check denominated in Canadian dollars at your local bank.

- In India, for example, in the India Direct Deposit Enrolment Form, Part C, note 6, (your financial institution in India will fill in the rest of part C), you authorize the Receiver General to convert your OAS payment to Indian rupees before depositing it in your account in your Indian bank.

- In Hong Kong, the exact same provision applies as well.

- In fact, converting to local currency is a part of all Direct Deposit Enrolment Forms, although in the Philippines they also add a list of qualified financial institutions where you must have an account to enable direct deposit.

Getting Your OAS as a Naturalized Citizen in Canada – Update October 23, 2014

If you are a naturalized Canadian citizen and you are applying for Old Age Security (OAS) then you must now submit further documentation as the Canadian government has implemented a stricter policy in the last few years. This has turned out to be a nightmare for those who arrived in Canada many years ago, usually as young children, who are having difficulty producing the documentation now required by Service Canada to receive their OAS. Take a few minutes to review the new requirements, even if your age of retirement is still a long way off. Keeping records now of your landing in Canada, and any trips out of Canada and back to Canada, is vital if you want a smooth application for your OAS and you were not born in Canada.

In the 2012 budget, the government announced it was increasing the eligibility age for OAS for those born in March 1958 and later up to 67 from 65. The change takes effect in 2023 as those born in March 1958 and later turn 65 and it is, by all standards, a modest change. Alongside this official change, however, a policy that now demands more documentation for those eligible for OAS (Naturalized Canadians and Permanent Residents who have lived in Canada at least 10 years, or 20 years if you are now living abroad and applying for OAS) has also been put in place. And this is where it gets tricky if you don’t have copies of plane tickets or older copies of your passport or Landing Documents with entry and exit stamps clearly showing how much time you have spent in Canada.

Service Canada spokesperson Amelie Maisonneuve stated recently in an email to the media that “an applicant may be asked to provide documents to substantiate the departures from and entries into Canada in order to validate residence in Canada. Old Age Security is completely funded by taxpayers’ dollars and it is important that we ensure the integrity of the program, providing benefits only to those who are eligible.” In other words, if you are a naturalized Canadian, the burden of proof of residency in Canada is on you, and you have to provide documentation that satisfies Service Canada, although it is not strictly clear what that may be in any given case. Here is a rough guide to documentation you may need to present, to qualify for OAS:

- The best document you can present is the Confirmation of Permanent Residence Document or Landing Document that you received at the border when entering Canada as a Permanent Resident. For those who arrived in Canada as young children many years ago finding this document is next to impossible.

- Older passports that have a stamp showing your entry as a Permanent Resident into Canada are also valid.

- Customs declarations from years past that show your entry into Canada may also be used.

- Plane tickets have been requested on occasion from applicants as well.

- Another option is to contact IRCC and request they provide documentation of your status as a permanent resident of Canada for a $30 fee. You can also authorize Service Canada to contact IRCC on your behalf although this will involve a delay of about 6 months, or perhaps even longer.

At some point in the future, perhaps Service Canada will use their own data base of Social Insurance Numbers, or SIN’s, to confirm an applicant’s residence in Canada. But it seems a get-tough order has come down from above, in line with other tougher policies meant to combat immigration fraud. That means source documents showing your entry into Canada rather than SIN cards or proof of taxes filed. It begs the question of how big a problem OAS fraud is and how reasonable are the measures in place at this point. But rather than wait for a change in policy, it is now up to you to have the documentation necessary to prove to Service Canada that you have been a permanent resident of Canada for at least 10 years from the age of 18 if applying for OAS. If you are applying from overseas, then the residence requirement is 20 years from the age of 18. The moral of the story is that you should keep a big fat file with any documentation that shows your entry and exit into Canada, or any matter related to your entry and exit. That includes plane tickets as well. You will likely need it if you are a naturalized Canadian applying for OAS at some point in the future when you reach retirement age.