Can I Afford the Super Visa for My Parents?

You’re looking forward to bringing your parents or grandparents to visit you in Canada. You’ve heard all about the Super Visa program and how your parents (or grandparents) can stay for up to 2 years (and valid for up to 10 years) and/or be allowed multiple entries into Canada. But can you afford to?

Super Visa Income Requirement

You’re looking forward to bringing your parents or grandparents to visit you in Canada. You’ve heard all about the Super Visa program – officially called The Parent and Grandparent Extended Stay Temporary Resident Visa – and how your parents (or grandparents) can stay for up to 2 years (and valid for up to 10 years) and/or be allowed multiple entries into Canada.

In addition to meeting standard temporary residence requirements for any visitor to Canada, your parents/grandparents must also submit the following:

- A letter of invitation from you, the child or grandchild of the Super Visa applicants;

- One of the following documents to prove that you, the child or grandchild of the Super Visa applicants, meet the LICO (Low Income cut-off) minimum:

- Most recent copy of your Notice of Assessment from Canada Revenue Agency (CRA), OR

- Most recent copy of your T4 or T1 slips, OR

- A signed and dated letter from your Canadian employer stating your:

- Job Title,

- Job Description,

- Salary, OR

- Your most recent employment insurance pay stubs, OR

- A printed copy of your tax returns, obtained online by using CRA’s My Account.

- Documented proof of your parents/grandparents’ relationship to you (for example: your long term birth certificate naming your parents, translated if necessary)

- Proof of valid Health Insurance with a Canadian insurance company, in the form of a copy of the insurance policy or certificate. Must be for a minimum term of 1 year and a minimum coverage of CAD$100,000 required.

Here are the minimum income levels you must meet in order for your parents/grandparents to visit you in Canada using a Super Visa as of June 2016. The family size refers to your family unit.

| Size of Family | Minimum Required Income |

|---|---|

| 1 person | CAD$24,949 |

| 2 persons | CAD$31,061 |

| 3 persons | CAD$38,185 |

| 4 persons | CAD$46,362 |

| 5 person | CAD$52,583 |

| 6 persons | CAD$59,304 |

| 7 persons | CAD$66,027 |

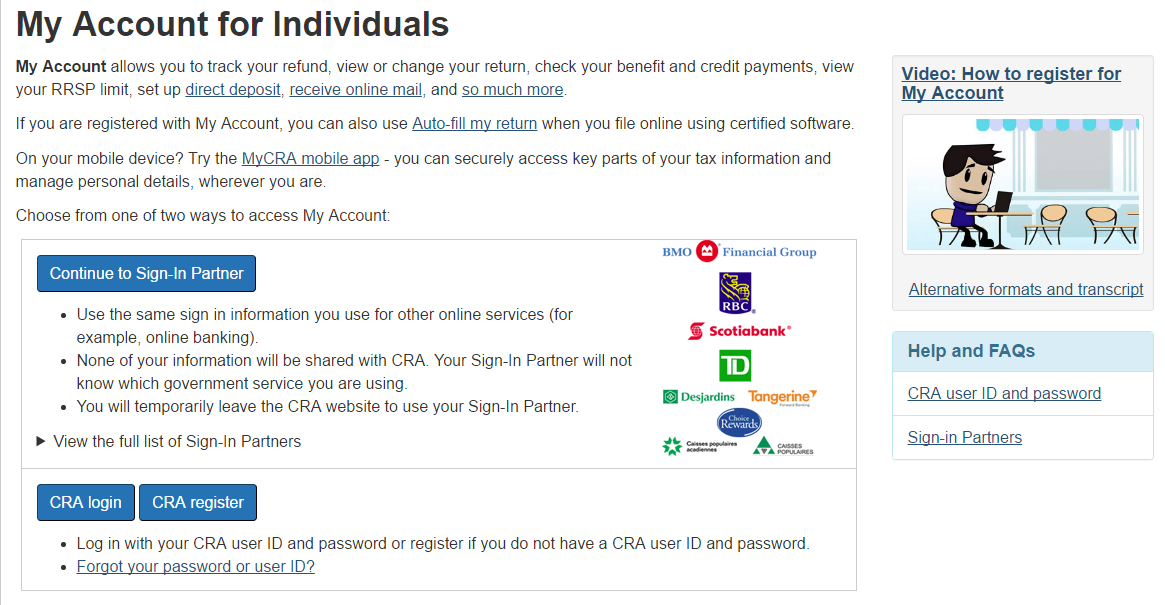

As you can see, in order to prove you meet the LICO minimum, it is very helpful to register for a My Account with the Canada Revenue Agency. Here’s how to go about getting your My Account opened and up and running with the CRA.

Free in-depth Immigroup course: Canada Visitor Visa (TRV) Course

What is My Account?

My Account is a secure online portal run by CRA that allows you to:

- View your personal tax and benefit information online, and print it off, if necessary (such as for a Super Visa application);

- Manage your tax affairs online.

It is available 21 hours a day:

| Time Zones | Hours When service Available |

|---|---|

| Pacific Time | 3 AM – Midnight |

| Mountain Time | 4 AM – 1 AM |

| Central Time | 5 AM – 2 AM |

| Eastern Time | 6 AM – 3 AM |

| Atlantic Time | 7 AM – 4 AM |

| Newfoundland Time | 7:30 AM – 4:30 AM |

| Outside Canada and USA (Eastern Time) | 3 AM – 6 AM |

How do I sign up for a My Account with Canada Revenue Agency?

You can use your online banking account information (password and username) to sign up with My Account. The following Canadian Financial Institutions are eligible:

- BMO Financial Group;

- Royal Bank of Canada;

- Scotiabank;

- TD Bank Group;

- Desjardins Group;

- Tangerine;

- Choice Rewards MasterCard.

Step 1:

Go here at CRA’s website to start the process of registering for your My Account. You will have to enter the following personal information:

- Your social insurance number (SIN).

- Your date of birth.

- Your postal/zip code.

- You will then be requested to enter an amount from your latest tax return, so you must have a copy of your latest tax return available BEFORE you begin the process of registering. The portal will ask you for the amount from a specific line of your tax return. The exact line the portal chooses will vary for each registration. This is a way to confirm your identity.

- You will then create your CRA User ID and Password:

- Your User ID must:

- Be between 8 and 16 characters long;

- NOT contain any empty spaces;

- Can contain up to 7 digits (numbers) as well as letters;

- You may use ONLY the following special characters: a dot(.) a dash (-) an underline (_) or an apostrophe (´);

- Be unique – you will be informed if your User ID is already taken.

- Your Password must:

- Be between 8 and 16 characters long;

- NOT contain any empty spaces NOR accented letters;

- Contain at least 1 Upper Space (capitalized) letter;

- Contain at least 1 lower case (not capitalized) letter;

- Contain at least 1 digit (number);

- NOT use more than 4 consecutive, identical characters (e.g. 1111 or aaaa);

- Use ONLY the following special characters: a dot (.) a dash (-) an underline (_) or an apostrophe (´).

- You will then create your security questions and answers. You can choose to add a cookie to your device to avoid being asked for personal identification the next time you use the same device to access your My Account.

Step 2:

You will receive your CRA security code by mail 5 to 10 days later, if you reside in Canada; 10 – 15 days later if you reside in the USA or elsewhere outside of Canada. Your CRA security code has an expiry date, which will be indicated in the letter you receive. Open the letter as soon as you receive it and follow the instructions BEFORE the expiry date. If you delay until after the expiry date, you will have to contact them.

To access your account, once you have received your CRA security code:

- Go here, to the My Account for individuals and click on the blue CRA Log-in button.

- Enter your User ID and your Password;

- When prompted, enter your CRA security code.

Please note that if you forget your User ID and/or Password, you cannot recover it. You will have to register again, and create a new User ID and Password.

Congratulations! You now have online access to your tax information, and you can easily save and print out your tax return or your T4 or T1 slips, and use them as proof for your parents or grandparents Super Visa application.

Let Immigroup help you get your Super Visa – Click Hear To Learn More