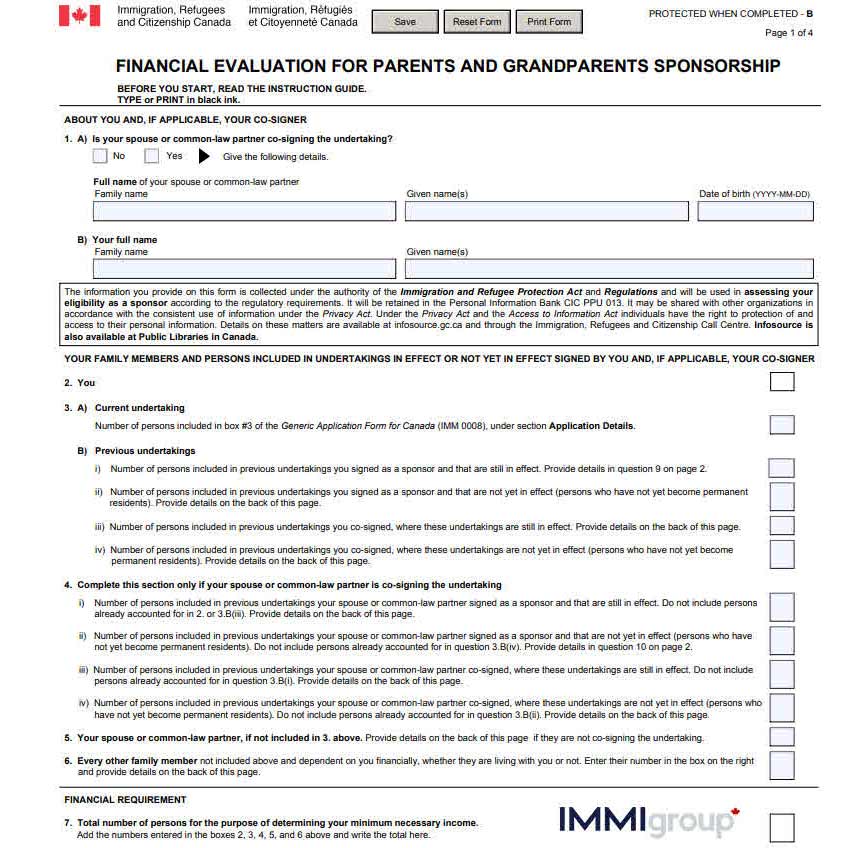

Form IMM 5768: Financial Evaluation for Parents and Grandparents Sponsorship

Completing Form IMM 5768: Financial Evaluation for Parents and Grandparents Sponsorship

Just as the sponsor is evaluated financially in a spousal sponsorship, you the sponsor have to show IRCC officials you have a strong enough financial situation to be able to sponsor your parents, grandparents, and any dependents of theirs.

Form IMM 5768 is where you do this, so let’s take a look at the form:

Is this image familiar? It should be, seeing it’s in Step 1 where we talk about the financial requirements that come with being a sponsor and how to calculate how many people depend on you and thus what your required income is estimated to be.

Just remember, IRCC has the final say on your income requirements, but using our table and form IMM 5768 and form IMM 5748 (see the next chapter) you can get a pretty good idea if your income is high enough to be a sponsor.

Let’s keep working through form IMM 5768.

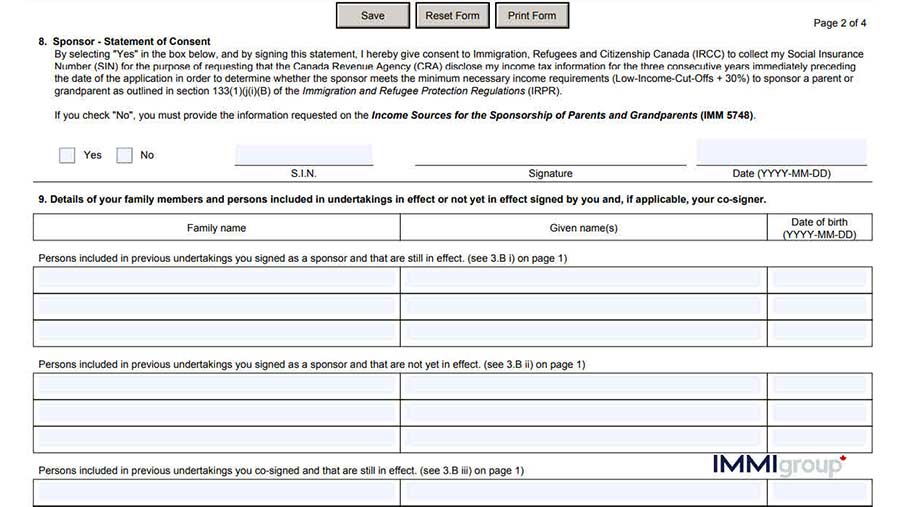

Do you recall what we advised for question 8 in form IMM 5768? It’s where you can choose to hand your Social Insurance Number (SIN) over to IRCC and let them directly obtain your tax information for the 3 preceding years.

Or, you can choose to obtain your NOA (Notice of Assessment) which is what Canada Revenue Agency (CRA) sends you after you file your annual taxes in April. You will have to obtain and print out the 3 most recent NOAs. See Chapter 1 above for details on how to do that through your account at CRA (or how to create an account at CRA).

Please note that you (as well as any co-signer) will also have to complete a form IMM 5748: Income Sources for the Sponsorship of Parents and Grandparents, if you choose NOT to allow IRCC direct access to your tax information. See below for more information on this form.

You’ll notice that after choosing whether to let IRCC obtain your tax information in question 8, you will then have to list any current or yet-to-begin undertakings you are responsible for. If you have any current sponsorships in effect – often this may be your spouse who you sponsored and then after a few years but before that sponsorship’s term has ended – you have to list each one.

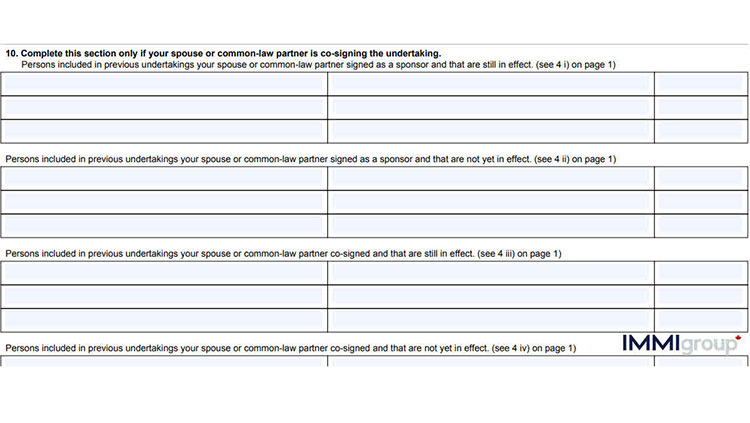

Next in question 10, we return to the issue of a co-signer. If your spouse has agreed to co-sign you must complete this section:

As you can see, this is a declaration by your spouse of any undertakings still current that they have agreed to.

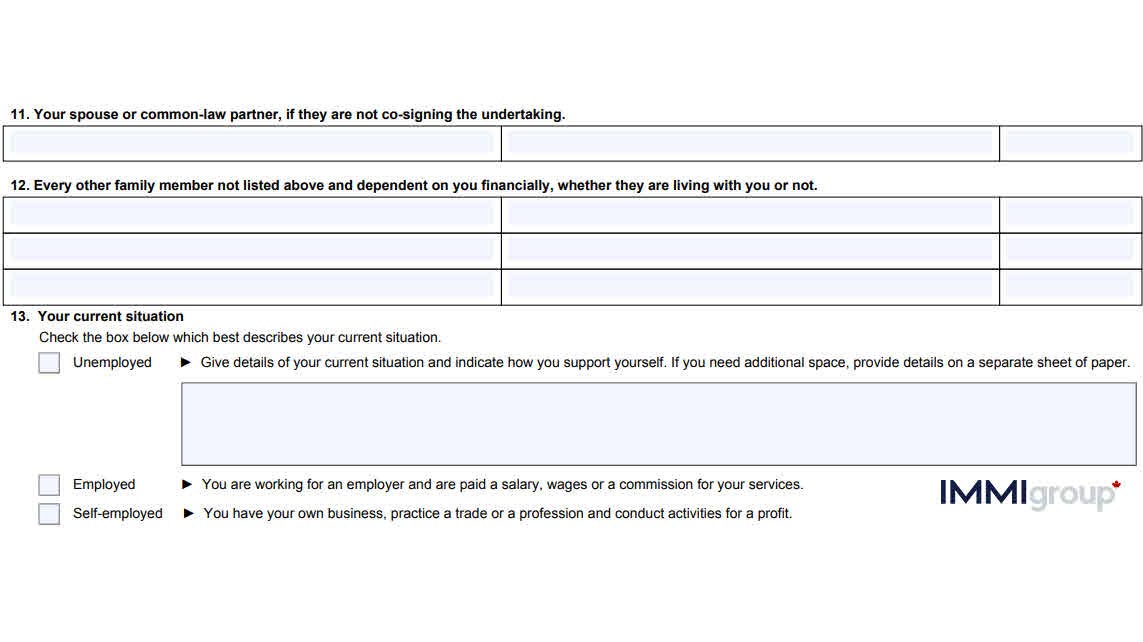

Questions 12 asks you to list any family members not being sponsored but who are dependent on you financially even if they are not living with you. This is IRCC’s way of estimating your total financial obligations by including any possible obligation you may have beyond those you have formally agreed to undertake through a sponsorship.

Question 13 asks you about your current employment situation.

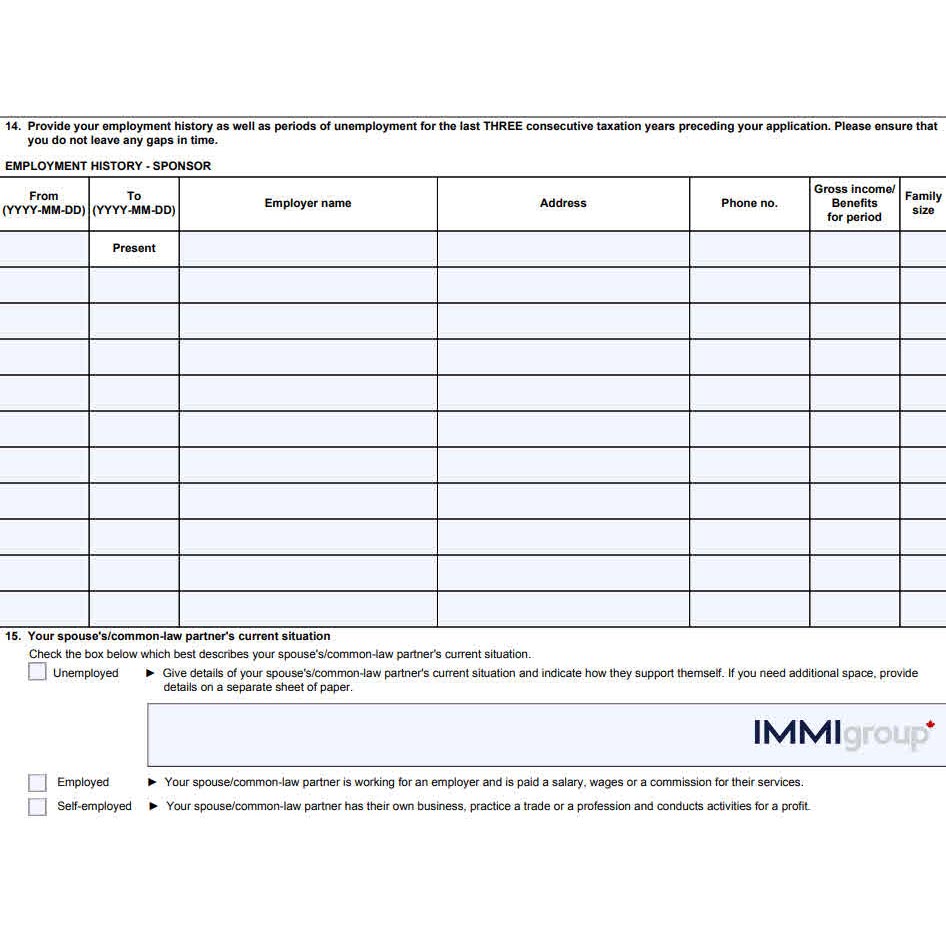

Question 14 asks you about your previous employment over the past 3 tax years.

Question 15 asks your co-signer about their current employment situation.

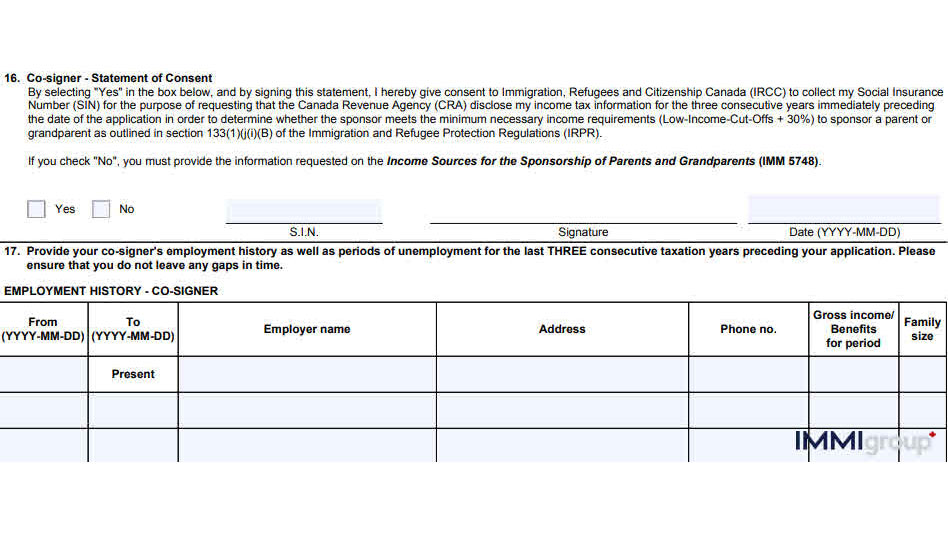

Question 16 asks your co-signer whether they consent to giving IRCC authority to obtain their tax information directly from CRA by giving them their SIN and signing the consent.

If the co-signer (your spouse) does NOT want to give IRCC direct access to their tax information and check NO on question 16, then they must download and fill out form IMM 5748: Income Sources for the Sponsorship of Parents and Grandparents. (see the next chapter for more information on form IMM 5748). This is the same requirement as we mentioned applies to you the sponsor if you choose not to give IRCC direct access to your tax information.

Finally, Question 17 asks your co-signer to list their previous employment over the past 3 tax years.

Free Immigration Updates

The Canadian immigration industry is constantly changing. Don’t miss important updates or changes in the law. Stay informed with Immigroup’s “best in the industry” newsletter. We’ll keep you current on all the latest updates.