IMM 1283 Financial Evaluation

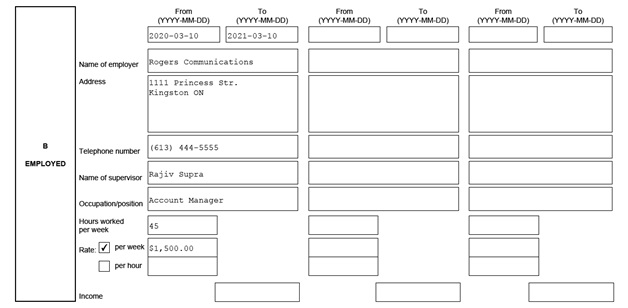

The Sponsor fills out the IMM 1238 form if you are sponsoring a dependent child with dependent children of their own. The purpose is to assess your ability to take on the obligations of these additional dependents (along with your sponsored spouse/partner and their/your children). So, you will have to answer questions about your income for example.

If your sponsored spouse has no dependent children you do not need to complete this form.

Let’s take a quick tour through this fairly elaborate form.

First of all, you are permitted to have a Co-signer who can help you meet your financial requirements that are set out below in case your income is too low. But your Co-signer will be fully responsible for the undertakings they signed if you are unable to fulfill them.

Your spouse/partner can be a co-signer but if this is the case, remember to answer:

- Question 1.B and

- Questions 15 through 19.

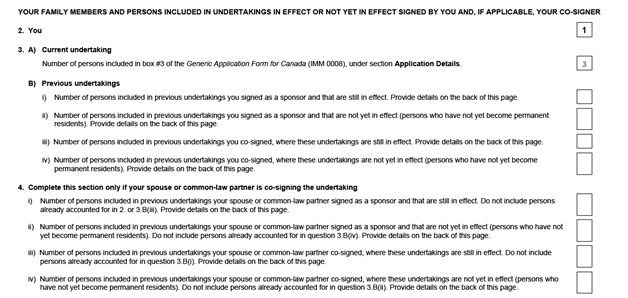

Questions (boxes) 1 through 7 are the same as in the IMM 5481 which we just covered so the total in box 7 will now be used to calculate your required income as a sponsor who has this number of dependent family members (whether your family or your spouse/partner’s).

How to calculate the required income for the IMM 1283 Financial Evaluation Form:

Use the Canadian Federal Government’s Low-income Cut-off (LICO) Table that you may have seen for other IRCC application streams:

| Low Income Cut-Off (LICO) as of 2021 | |

|---|---|

| Size of Family Unit | Minimum necessary income |

| 1 person (the sponsor) | $25,921 |

| 2 persons | $32,270 |

| 3 persons | $39,672 |

| 4 persons | $48,167 |

| 5 persons | $54,630 |

| 6 persons | $61,613 |

| 7 persons | $68,598 |

| More than 7 persons, for each additional person, add | $6,985 |

Use the number from box 7 to calculate your required income. Remember box 7 is the sum of questions (boxes) 4, 5, and 6.

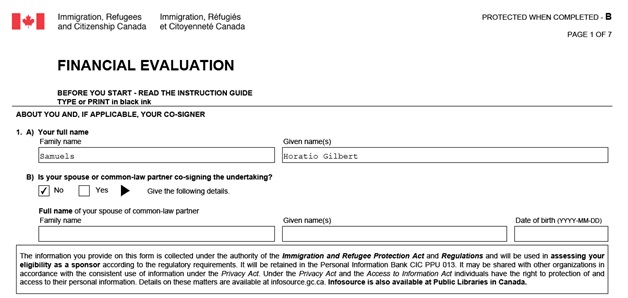

In our case Carmen is NOT co-signing the undertaking so we do not even have to list her name at the top of the form. (In fact the PDF will not let fill in those boxes you if you answer No to the question: Is your spouse or common-law partner co-signing the undertaking?)

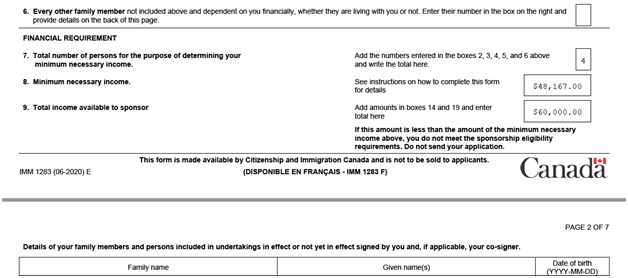

In our case the number is 3 so our sponsor, Horatio Gilbert Samuels, has to earn at least $39,672 which he fills in Box 8 on the form. (In our example, he doesn’t have to complete this form. But we are showing what he would have to do if he had to complete the form.)

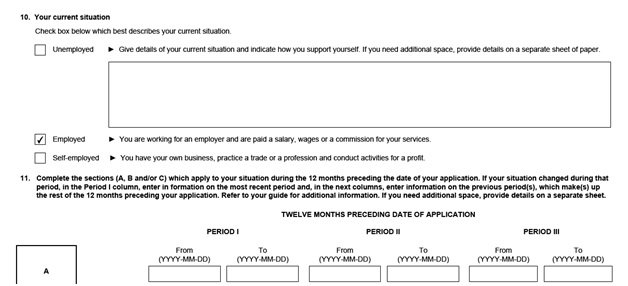

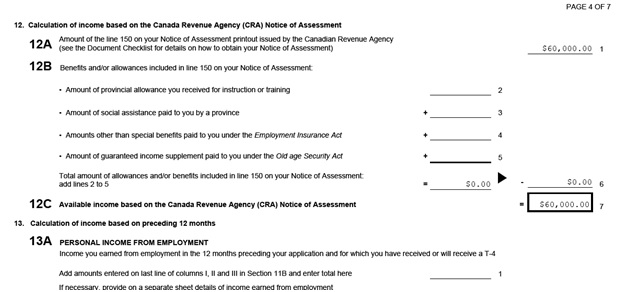

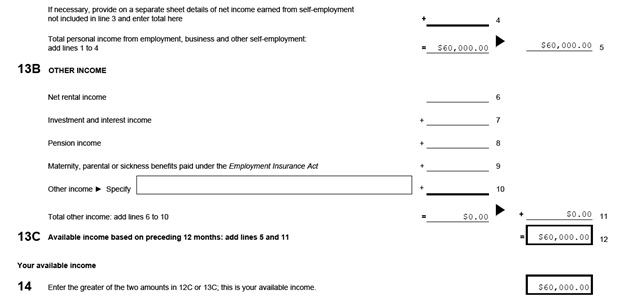

For the total in box (question) 9 you need to scroll down the form and answer questions 10 through 14. This involves summarizing your most recent Notice of Assessment (NOA) which is what the Canada Revenue Agency sends back to your after processing your taxes. Essentially they are looking for your gross income.

As well, if your spouse/partner has filed taxes in Canada you should answer questions 15 to 19 which are identical to questions 10 through 14, except they are for your spouse’s gross income earned in Canada in the most recent tax year. They should be filled in if your spouse/partner is a Co-Signer as we mentioned above.

As well, if your spouse/partner has filed taxes in Canada you should answer questions 15 to 19 which are identical to questions 10 through 14, except they are for your spouse’s gross income earned in Canada in the most recent tax year. They should be filled in if your spouse/partner is a Co-Signer as we mentioned above.

As you can see, the form is similar to the previous form except for the income requirements and these sections. We have left out the details of other dependents which is as on the previous form as they have no other financial dependents.

As a Sponsor, you have almost certainly completed at least 1 year of tax returns so this step should not be too unfamiliar. You are just taking a few bits of key information from your NOA and transferring those numbers to form IMM 1283.

So, as you have seen, forms IMM 5481 and IMM 1283 are quite similar but IMM 1283 is slightly more involved due to your sponsored spouse/partner having a dependent child who has a dependent child of their own. And this raises the required income to $48,167.